Navigating the world of loans can feel overwhelming. You might hear terms like “refinancing” tossed around, but what does it really mean? For many borrowers, loan refinancing represents a golden opportunity to save money and improve their financial situation. But is it right for you? Understanding the ins and outs of refinancing can help you make informed decisions about your finances. Whether you’re looking to lower your monthly payments or tap into your home’s equity, this guide will shed light on everything you need to know before taking the plunge into loan refinancing. Let’s explore how this financial strategy could work in your favor!

What Is Loan Refinancing?

This can be done for various types of loans, including mortgages, auto loans, or student loans. The main goal is to secure better terms that fit your current financial situation. When you refinance, you might obtain a lower interest rate, extend or shorten the loan term, or even change the type of loan altogether. This move can lead to significant savings over time and may also provide fresh funds for other expenses if you’re tapping into equity. Essentially, it’s like hitting refresh on your financial commitments. A chance to improve your cash flow and adapt to life changes.

Benefits of Loan Refinancing

Loan refinancing can provide significant financial advantages that make it an appealing option. One of the most attractive benefits is the potential for lower interest rates. This can lead to reduced monthly payments and save you money over time. Another advantage is the opportunity to consolidate debt. Additionally, refinancing can help adjust your loan term. You might choose to extend your repayment period for smaller payments or shorten it to pay off your debt faster.

When Is the Right Time to Refinance?

Timing can be crucial when considering refinancing. One key moment is when interest rates drop significantly. If you notice a rate that’s at least 1% lower than your current loan, it might be wise to explore options. Another important factor is your credit score. A higher score can qualify you for better rates and terms. If you’ve improved your financial standing since taking out the original loan, this could be an ideal time to refinance. Additionally, if you’re looking to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage for stability, now may also be advantageous.

Factors to Consider Before Refinancing

Before jumping into refinancing, it’s crucial to evaluate your financial situation. Take a close look at your credit score. A higher score can unlock better rates, saving you money in the long run. Next, consider the terms of your current loan. Are you still within a favorable interest rate? If so, refinancing might not be beneficial. Think about how long you plan to stay in your home or keep the loan. If moving is on the horizon, paying closing costs may not make sense. Also, calculate all associated fees and expenses related to refinancing. These can add up quickly and impact overall savings.

The Process of Refinancing

Refinancing a loan can seem daunting, but it’s straightforward once you break it down. Start by assessing your current financial situation and determining the goals you want to achieve. Are you looking for lower monthly payments or a shorter loan term? Next, research different lenders and their offerings. Compare interest rates, fees, and terms to find the best fit for your needs. Gathering documentation like income statements, credit reports, and existing loan details is crucial at this stage.

In Conclusion

Refinancing a loan can be a strategic move that opens doors to better financial opportunities. It’s essential to weigh the benefits against potential drawbacks and understand your personal situation before making a decision. Take the time to evaluate interest rates, terms, and fees associated with refinancing. This way, you’ll be equipped to make an informed choice tailored to your needs. Whether it’s lowering monthly payments or tapping into equity …

When it comes to financing your niche pursuits, traditional loan options may not always be the perfect fit. That’s where

When it comes to financing your niche pursuits, traditional loan options may not always be the perfect fit. That’s where

If you find yourself struggling to pay off your existing debts, it may not be the best time to apply for a loan. Taking on additional debt when you’re already having difficulty managing your current financial obligations can create a vicious cycle that’s hard to break free from. It’s going to be chaotic if you pay off your current debt using a new loan.

If you find yourself struggling to pay off your existing debts, it may not be the best time to apply for a loan. Taking on additional debt when you’re already having difficulty managing your current financial obligations can create a vicious cycle that’s hard to break free from. It’s going to be chaotic if you pay off your current debt using a new loan.

Personal loans typically come with fixed terms, meaning you must make payments for a set amount of time. However, if you have the means, paying off the loan early can help save you money in the long run. Not only will you save on interest charges, but you’ll also have the peace of mind of knowing you’re debt-free. Personal loans can be a valuable tool for managing your finances, but using them responsibly is important. By following these essential tips – knowing your credit score and shopping around for the best rates, using the loan for its intended purpose, making payments on time, and paying off the loan early if possible –, you can make the most of your loan and avoid getting into further financial trouble.…

Personal loans typically come with fixed terms, meaning you must make payments for a set amount of time. However, if you have the means, paying off the loan early can help save you money in the long run. Not only will you save on interest charges, but you’ll also have the peace of mind of knowing you’re debt-free. Personal loans can be a valuable tool for managing your finances, but using them responsibly is important. By following these essential tips – knowing your credit score and shopping around for the best rates, using the loan for its intended purpose, making payments on time, and paying off the loan early if possible –, you can make the most of your loan and avoid getting into further financial trouble.…

In this era, crowdfunding is an increasingly popular way for people to gain financial assistance for medical expenses. There are several crowdfunding platforms available, and each one has a slightly different process for setting up campaigns, collecting donations, and dispersing funds. With the help of social media networks, you can quickly spread awareness of your cause and attract generous donors from around the globe.

In this era, crowdfunding is an increasingly popular way for people to gain financial assistance for medical expenses. There are several crowdfunding platforms available, and each one has a slightly different process for setting up campaigns, collecting donations, and dispersing funds. With the help of social media networks, you can quickly spread awareness of your cause and attract generous donors from around the globe.

In a failing economy, it can be challenging to get ahead. Many of us find ourselves barely scraping by, even when we’re employed. So, what can a loan do for us?

In a failing economy, it can be challenging to get ahead. Many of us find ourselves barely scraping by, even when we’re employed. So, what can a loan do for us? So, what’s the verdict? Should we take out

So, what’s the verdict? Should we take out

Another essential step to financial freedom is paying off your

Another essential step to financial freedom is paying off your  Investing is another crucial step on the road to financial freedom. However, you must invest in a suitable investment. You want to invest in something that will give you a good return on your investment.

Investing is another crucial step on the road to financial freedom. However, you must invest in a suitable investment. You want to invest in something that will give you a good return on your investment.

The first and most important thing you need to do is be realistic about your finances. It means taking a close look at your income and expenses. Make sure you are honest with yourself and include everything. Once you have a clear picture of your financial situation, you can start looking for ways to reduce your expenses. You may be surprised by how much money you can save by making minor changes to your lifestyle. If you are still struggling to pay your tax debts after making some cuts to your expenses, you may need to consider other options.

The first and most important thing you need to do is be realistic about your finances. It means taking a close look at your income and expenses. Make sure you are honest with yourself and include everything. Once you have a clear picture of your financial situation, you can start looking for ways to reduce your expenses. You may be surprised by how much money you can save by making minor changes to your lifestyle. If you are still struggling to pay your tax debts after making some cuts to your expenses, you may need to consider other options. However, you should consider hiring a tax relief company if things get worse. Many reputable companies can help you deal with your tax debts. They will work with the IRS on your behalf and negotiate a payment plan or settlement. But before you hire a tax relief company, make sure you do your research. Check their Better Business Bureau rating and read online reviews. However, you should also be aware of scams. It is as some tax-relief companies will make false promises and charge you high fees.

However, you should consider hiring a tax relief company if things get worse. Many reputable companies can help you deal with your tax debts. They will work with the IRS on your behalf and negotiate a payment plan or settlement. But before you hire a tax relief company, make sure you do your research. Check their Better Business Bureau rating and read online reviews. However, you should also be aware of scams. It is as some tax-relief companies will make false promises and charge you high fees.

One of the biggest drawbacks of final expense insurance is that it can be quite expensive. You will have to pay a monthly premium to maintain your coverage in most cases. This can add up over time, and it may end up costing more than you’re able to afford. Additionally, the amount of coverage you receive may not be enough to cover all of your funeral costs. If you don’t have a lot of money saved up, this could be a major problem.

One of the biggest drawbacks of final expense insurance is that it can be quite expensive. You will have to pay a monthly premium to maintain your coverage in most cases. This can add up over time, and it may end up costing more than you’re able to afford. Additionally, the amount of coverage you receive may not be enough to cover all of your funeral costs. If you don’t have a lot of money saved up, this could be a major problem.

The first thing you should do is research different mortgage brokers. This can be done online or by asking family and friends for referrals. When researching mortgage brokers, be sure to look at reviews from past clients. This will give you a good idea of what to expect from the broker.

The first thing you should do is research different mortgage brokers. This can be done online or by asking family and friends for referrals. When researching mortgage brokers, be sure to look at reviews from past clients. This will give you a good idea of what to expect from the broker. When applying for a mortgage, the broker will want to see that you are financially stable. This means that you should have a good credit score and afford the monthly payments. If you do not meet these requirements, the broker may not help you. This is why it is essential to start preparing for a mortgage well in advance. You should also make sure that you are on top of your finances and avoid making late payments.

When applying for a mortgage, the broker will want to see that you are financially stable. This means that you should have a good credit score and afford the monthly payments. If you do not meet these requirements, the broker may not help you. This is why it is essential to start preparing for a mortgage well in advance. You should also make sure that you are on top of your finances and avoid making late payments.

The first thing you need to consider is why you seek a loan. Ask yourself if this is for personal or business use and what you will use it for. Consider whether your credit score would allow for a larger amount of money versus a lower amount that may require monthly payments due to interest rates. If necessary, look into ways to improve your credit score to get a lower interest rate.

The first thing you need to consider is why you seek a loan. Ask yourself if this is for personal or business use and what you will use it for. Consider whether your credit score would allow for a larger amount of money versus a lower amount that may require monthly payments due to interest rates. If necessary, look into ways to improve your credit score to get a lower interest rate. The next thing you need to consider when choosing a potential lender is their reputation. Do your research and read reviews to get an idea of what people have said about this company in the past. It will help you make a more informed decision on whether or not to borrow money from them. Now that you know these five things, it’s time to start looking for a reputable lender.…

The next thing you need to consider when choosing a potential lender is their reputation. Do your research and read reviews to get an idea of what people have said about this company in the past. It will help you make a more informed decision on whether or not to borrow money from them. Now that you know these five things, it’s time to start looking for a reputable lender.…

When finding the right company to help you improve your credit score, consider the one with the best intentions to accommodate you. The process of improving your credit score is complex, and you need a company that has a solid understanding of the repair process and how to deal with contingencies that may occur and ensure that you have a good credit score. In addition, reputable credit repair companies have a proven track record of providing the best results for their customers.

When finding the right company to help you improve your credit score, consider the one with the best intentions to accommodate you. The process of improving your credit score is complex, and you need a company that has a solid understanding of the repair process and how to deal with contingencies that may occur and ensure that you have a good credit score. In addition, reputable credit repair companies have a proven track record of providing the best results for their customers. It is essential to establish a well-written contract with the credit repair company to understand the contract and know its covers. A well-written contract should have the costs and expectations that the firm’s includes in the contract. Reputable companies will write a clear contract for their customers to understand.

It is essential to establish a well-written contract with the credit repair company to understand the contract and know its covers. A well-written contract should have the costs and expectations that the firm’s includes in the contract. Reputable companies will write a clear contract for their customers to understand.

One of the crucial factors you should consider when choosing an online lender is security. It is essential to note that there has been an alarming increase in issues related to cybersecurity and online scammers.

One of the crucial factors you should consider when choosing an online lender is security. It is essential to note that there has been an alarming increase in issues related to cybersecurity and online scammers.

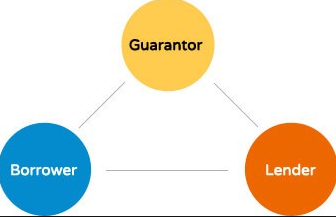

These loans are similar to unsecured loans because the borrower does not need to own a car, a piece of land or home because no collateral is needed. The borrower should get another person who will act as a guarantor for them. This happens because the borrower has a poor credit history or no credit history at all. The guarantor signs to pay the loan in case the borrower does not meet the agreed monthly repayments.

These loans are similar to unsecured loans because the borrower does not need to own a car, a piece of land or home because no collateral is needed. The borrower should get another person who will act as a guarantor for them. This happens because the borrower has a poor credit history or no credit history at all. The guarantor signs to pay the loan in case the borrower does not meet the agreed monthly repayments. This depends on the lender, but normally, after the receipt of all the documents required, the lender starts the processing and releases the funds. This should take no more than seven working days. After the decision is made to release the loan, the lender enters all the documents required and sends money to the borrower in the form of a cheque. As mentioned earlier, the whole process should not take more than seven business days.

This depends on the lender, but normally, after the receipt of all the documents required, the lender starts the processing and releases the funds. This should take no more than seven working days. After the decision is made to release the loan, the lender enters all the documents required and sends money to the borrower in the form of a cheque. As mentioned earlier, the whole process should not take more than seven business days.

The fundamental way to develop an economy is first to educate people about the finances and then give them access to the financial opportunities and institutions. With a more people becoming financially literate, it will be easy for them to use the available financial avenues in their country.

The fundamental way to develop an economy is first to educate people about the finances and then give them access to the financial opportunities and institutions. With a more people becoming financially literate, it will be easy for them to use the available financial avenues in their country. Financial literacy is a challenge to many individuals, especially in the developing world. This creates the need for the government to protect its individuals from the corrupt in the society. These are people whose aim, is to bring down development through violation of privacy and fraud. The right infrastructure and systems should be put in place to curb such violations. This will help the individual develop confidence and continually use financial services. It will grow the economy significantly.

Financial literacy is a challenge to many individuals, especially in the developing world. This creates the need for the government to protect its individuals from the corrupt in the society. These are people whose aim, is to bring down development through violation of privacy and fraud. The right infrastructure and systems should be put in place to curb such violations. This will help the individual develop confidence and continually use financial services. It will grow the economy significantly.