Have you ever heard of guarantor loans? Many people will say yes, but many of them are not familiar with how they work. Some cannot even explain what guarantor loans are. If you are planning to get such a loan, you must have the right information about the same. This article will discuss some of the frequently asked questions about guarantor loans. Read on.

How Does Guarantor Loans Work?

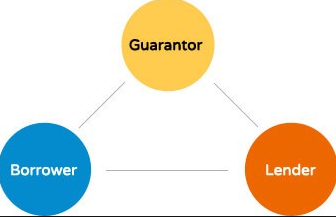

These loans are similar to unsecured loans because the borrower does not need to own a car, a piece of land or home because no collateral is needed. The borrower should get another person who will act as a guarantor for them. This happens because the borrower has a poor credit history or no credit history at all. The guarantor signs to pay the loan in case the borrower does not meet the agreed monthly repayments.

These loans are similar to unsecured loans because the borrower does not need to own a car, a piece of land or home because no collateral is needed. The borrower should get another person who will act as a guarantor for them. This happens because the borrower has a poor credit history or no credit history at all. The guarantor signs to pay the loan in case the borrower does not meet the agreed monthly repayments.

Who Is Eligible to Be a Guarantor?

Many people use a family member or a close friend. The only restriction is that you are not supposed to be sharing any credit items like bank accounts or credit cards with the person. The guarantor should have a good credit history as well. He or she must be a homeowner or anything else which acts as collateral.

What Does the Guarantor Do?

The guarantor’s job is to supply a credit score to enable the borrower to get guarantor loans. They will be required to sign some papers and make sure that they understand all the terms. Some lenders will ask for their pay slips and bank statements. The extreme requirement which rarely happens is that they will be held fully liable to pay the loan if the borrower fails to make payments as agreed.

How Fast Can I Get the Money?

This depends on the lender, but normally, after the receipt of all the documents required, the lender starts the processing and releases the funds. This should take no more than seven working days. After the decision is made to release the loan, the lender enters all the documents required and sends money to the borrower in the form of a cheque. As mentioned earlier, the whole process should not take more than seven business days.

This depends on the lender, but normally, after the receipt of all the documents required, the lender starts the processing and releases the funds. This should take no more than seven working days. After the decision is made to release the loan, the lender enters all the documents required and sends money to the borrower in the form of a cheque. As mentioned earlier, the whole process should not take more than seven business days.

Any Prepayments Needed?

There are no fees required for these kinds of loans. Be sure to have made the right evaluations of your finances to be in a position to repay the loan.…